Last updated on September 27, 2023 2:17 am

After the general budget, it has become clear that the Indian government is not going to ban cryptocurrencies in the country. Crypto Currency Taxes in India

Finance Minister Nirmala Sitharaman has announced in the Budget 2022 that income from cryptocurrencies will be taxed at the rate of 30 percent. The special thing is that the Central Bank i.e. Reserve Bank (RBI) is also going to launch its digital currency soon.

The long-running uncertainty surrounding cryptocurrencies has been removed in Budget 2022. Finance Minister has given clarity while making a big announcement on cryptocurrencies

Income tax rules on cryptocurrencies and other virtual digital assets VDA (Virtual Digital Assets) will be applicable from 1st April 2022 i.e. FY 2022-23. There are a lot of strings attached to this crypto and it adds to the complexities. Let us now understand the taxation related to cryptocurrencies in detail.

Till now no tax was to be paid on cryptocurrencies. For this reason, there was an uncertainty about whether it would continue for investment in the country or it would be banned.

Finance Minister Nirmala Sitharaman has made one more thing clear that while income on cryptocurrency will be taxed, even if there is a loss on it, tax will also have to be paid. Not only cryptocurrencies, income on transfer of any virtual assets will be taxed at 30 percent. At the same time, TDS has also been announced on transactions above a certain limit. For the time being, it is certain with this step that the government is not going to impose any kind of ban on cryptocurrency. But heavy tax has been imposed on the income from this. This move of the government will increase transparency regarding investment in cryptocurrencies.

New asset class for investment Crypto Currency Taxes in India

Now traders can trade in this asset class without any fear. The budget has removed the legal uncertainty over cryptocurrency trading. People can trade in crypto but they have to pay tax. However, it is to be seen that if corporates trade in crypto, then corporate tax is applicable or 30 per cent tax or whichever is higher.

Country’s first digital currency will come soon

By 2023, the Reserve Bank of India (RBI) will launch its own digital currency, which will be more secure and stable than other currencies. Simply put, the Reserve Bank of India prints paper currency, in the same way its sealed digital currency will also come, so that people will be able to invest in it.

What is the Tax Formula on Crypto Currency?

On every transaction (exceeding a limit) of digital currency, the government will have to pay one percent TDS separately.

If a person has invested in digital currency, then this investment is his asset.

Now if this person transfers this property to someone else, then he will have to pay TDS separately at the rate of one percent on the total cost of that property.

TDS means tax deducted at source. That is, the tax that is levied at any source.

Earnings from CryptoCurrency can be set off with the loss of the same head. That is, it cannot be adjusted with the income of any other head.

Also, if the income from Cryptocurrency in a financial year is negative, then it cannot be carried forward.

Most importantly, because cryptocurrencies are decentralized, central banks will not have their most essential functionalities to control the money supply in the economy.

One of the reasons for the popularity of cryptocurrencies was also that there was no tax on it. Now when heavy tax has been announced on this, then whether small investors will invest in it or not will be a matter to be seen.

Apart from this, the issue of the government’s own digital currency means that the government wants to reduce investment in private cryptocurrencies. Now in such a situation, small investors who want to earn profit by investing money in crypto will be seen avoiding it.

Taxation on Gifted Digital Assets

The government is trying to cover every possible loop hole regarding tax evasion in cryptocurrency, so they have made crypto gifting taxable in the hands of the recipient.

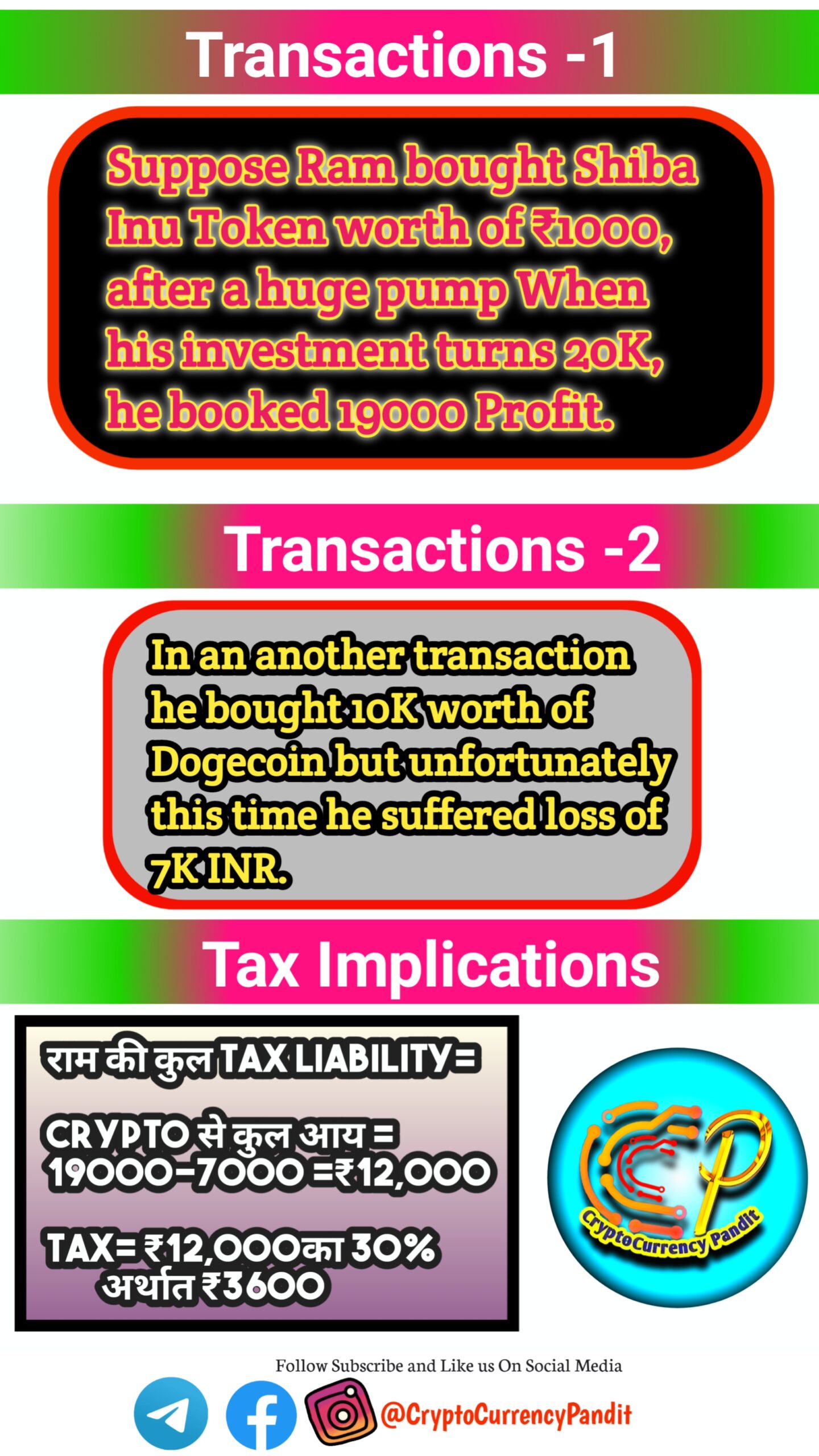

Example

Consider a person with a salary of Rs 18 lakhs,

profit on bitcoins worth 6 lakh rupees and

Loss on Litecoin worth Rs 2 lakh

He can deduct the loss, and the net profit from the sale of crypto assets (both bitcoin and litecoin) will be Rs 4 lakh.

4 lakh will be taxed at 30%, plus any applicable surcharges (nil in this case) and cess (1.2 percent, or 4% of 30% tax), for an effective tax rate of 31.2 percent.

The income tax slab and rate applicable to their salary income of Rs 18 lakh will be determined by the tax regime that they opted for during the financial year.

Be First to Comment